News Summary

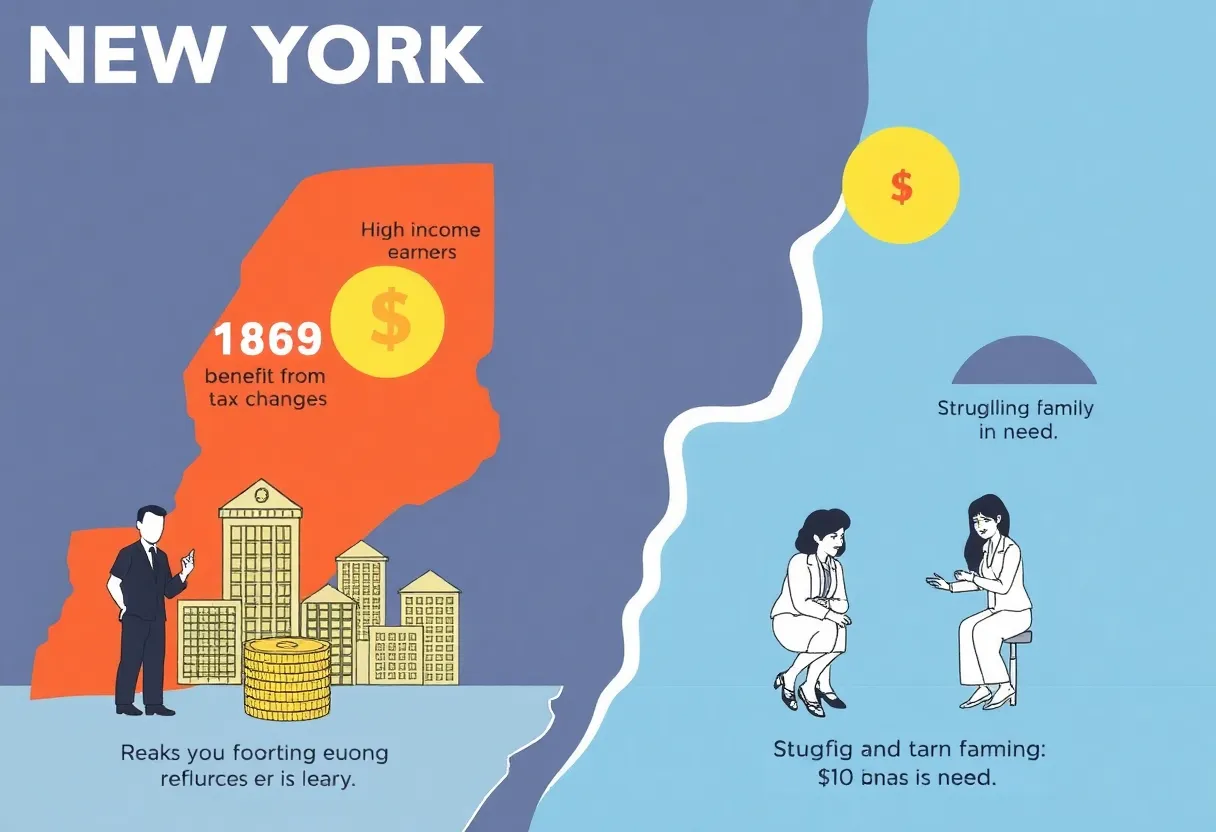

A new study by the New York State Comptroller’s Office highlights the unequal effects of recent federal tax legislation on New York residents. The report reveals that while wealthy individuals will benefit from various fiscal provisions, low- and middle-income families will face increased tax burdens. Specific changes, like temporary deductions and stagnant Child Tax Credit limits, underscore a growing economic disparity. Comptroller Thomas P. DiNapoli stresses the long-term challenges for struggling households as benefits for upper-income taxpayers solidify existing inequalities.

New York – A recent study by the New York State Comptroller’s Office has shed light on the effects of new federal budget and tax changes on the residents of New York. The report indicates a clear trend where the wealthiest individuals in the state will see significant benefits, while low- and middle-income families will face increased tax burdens as a result of the legislation.

The study suggests that the latest federal tax provisions continue to favor high-income earners, putting additional financial pressure on struggling households. State Comptroller Thomas P. DiNapoli emphasized that the ongoing system of tax changes reflects a pattern of supporting wealthier residents at the expense of those who are less fortunate.

The new tax legislation solidifies many of the changes introduced by the 2017 Tax Cuts and Jobs Act (TCJA), perpetuating a trend that analysts deem unequal. In addition to making numerous permanent tax alterations, the report highlights that while new tax breaks were proposed for seniors and working-class Americans, their breadth and duration are limited. Most notably, a series of temporary provisions designed to benefit low- and middle-income taxpayers will only be active from the years 2025 to 2028.

Among these temporary measures are deductions specifically tailored for seniors, overtime pay, tip income, and auto loan interest. However, this limited window exacerbates concerns since low-income households are anticipated to see a rise in federal tax liabilities by 2031 after temporary benefits expire.

In contrast, taxpayers earning up to $500,000 will benefit from a temporary increase in itemized deductions for state and local taxes (SALT), which will escalate from $10,000 to $40,000 for the tax year 2025. However, this increase is notably short-lived, reverting to the original cap of $10,000 for all filers by the year 2030. In 2023, more than 1.5 million New Yorkers utilized the SALT deduction, and 76% reported taxes exceeding this federal limit.

The temporary elevation in SALT deductions is expected to primarily assist middle and upper-income taxpayers, particularly those earning between $100,000 and $500,000. Meanwhile, lower-income individuals may see slight increases in standard deductions, although the real financial aid remains limited.

Additionally, the Child Tax Credit, which increases to $2,200 per child starting in tax year 2025, will face setbacks as the refundable portion is not indexed to inflation. This stagnation is likely to erode benefits for low-income families over time. In 2022, approximately 2.1 million taxpayers in New York claimed $6.1 billion in federal child tax credits, showcasing the program’s significance to working families.

Despite rising childcare costs, the maximum eligible expenses for the child and dependent care credit have remained unchanged at $3,000 per child. Many families are aware that the average cost for one child in New York in 2023 was nearly five times this cap. Consequently, only a minuscule 3.3% of total filers claimed this credit in 2023, with the majority of claimants earning incomes exceeding $105,000.

The report concludes that low- and middle-income families are unlikely to see substantial long-term benefits from the recent federal tax changes, leading to greater economic disparities in New York. As the government navigates these tax alterations, the impact on various income groups presents challenges that may persist for years to come.

Deeper Dive: News & Info About This Topic

- LoHud: NY Low Pay Workers Don’t Get New Tax Break for Tips

- CBIZ: Tax Provisions in New York State’s Fiscal Year 2026 Budget

- News10: Tax Provisions in the 2025 New York Budget

- Wikipedia: Taxation in the United States

- Forbes: Key Issues Surrounding Zohran Mamdani’s NYC Tax Increase

Author: STAFF HERE NEW YORK WRITER

The NEW YORK STAFF WRITER represents the experienced team at HERENewYork.com, your go-to source for actionable local news and information in New York, the five boroughs, and beyond. Specializing in "news you can use," we cover essential topics like product reviews for personal and business needs, local business directories, politics, real estate trends, neighborhood insights, and state news affecting the area—with deep expertise drawn from years of dedicated reporting and strong community input, including local press releases and business updates. We deliver top reporting on high-value events such as New York Fashion Week, Macy's Thanksgiving Day Parade, and Tribeca Film Festival. Our coverage extends to key organizations like the Greater New York Chamber of Commerce and United Way of New York, plus leading businesses in finance and media that power the local economy such as JPMorgan Chase, Goldman Sachs, and Bloomberg. As part of the broader HERE network, including HEREBuffalo.com, we provide comprehensive, credible insights into New York's dynamic landscape.